The Futures - No. 15

From Quantumrun

TLDR: In this issue

The Quantumrun team shares actionable trend insights about green technologies causing a global critical mineral shortage, the US experiencing re-industrialization, the potential return of the wooly mammoth, and actors protesting against being digitally replaced.

Future signals to watch

The EU passed a nature restoration law, which mandates recovery measures on 20 percent of the EU's land and sea by 2030.

Imagine an AI that can conduct full-length sales and customer service calls. Air's groundbreaking conversational AI is shaking things up.

Biotech company Colossal plans to de-extinct some animals, starting with the wooly mammoth. Jurassic Park fans, the future is around the corner!

Big Tech and social media companies are adopting ActivityPub, an open protocol that can make social platforms interoperable.

Google Cloud partners with Mayo Clinic to enable the medical center to create customized chatbots through generative AI.

A group of researchers discovered that the number of exoplanets similar to Earth that have liquid water (and therefore can support life) may be much higher than previously estimated.

Hollywood actors joined writers on strike against film studios offering a one-time payment for body-scanning background actors and using their likeness in perpetuity through AI. James Van Der Beek, of Dawson’s Creek fame, provided a surprisingly succinct overview of the artistic issues at risk.

Fascinating look at surgical AR from Medivis that applies 3D, real-time visualization for the efficient surgical planning of a patient's anatomy.

The US and the EU agree on a data-sharing deal, allowing businesses to transfer data from the EU to the US. (Meta is breathing a sigh of relief.)

The green revolution may trigger a global mineral supply crisis: Geopolitical foresight

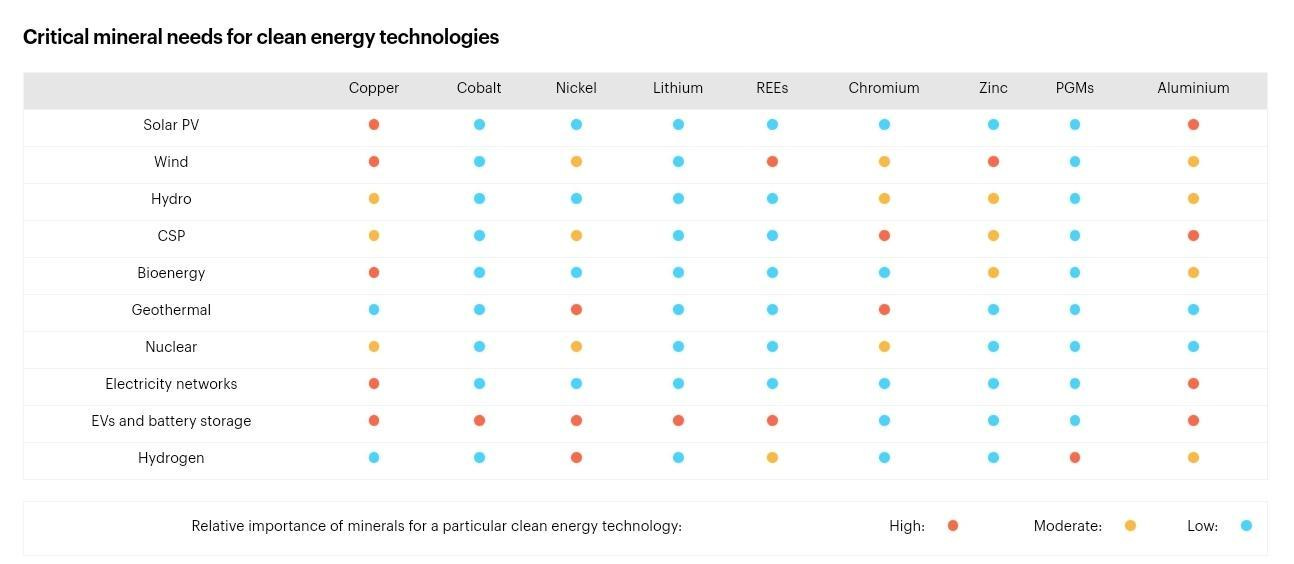

The transition to clean energy by 2040 will significantly increase mineral demand, with half of this growth caused by electric vehicles (EVs) and battery storage. In various International Energy Agency (IEA) scenarios, mineral demand from these subgroups increases by as much as 30 times. By 2040, graphite, copper, and nickel will dominate mineral demand by weight, with lithium experiencing the fastest growth, increasing over 40 times.

This demand will be even higher considering the resource needs for solar and wind power. The challenge lies not only in the availability of these resources but also in the capacity to extract them in time. The interplay between geopolitics, green minerals, and decarbonization also presents a significant hurdle.

Achieving net zero emissions or carbon neutrality is a defining task of the 21st century. However, the material requirements for this transition are often overlooked. Some developed nations have reduced emissions by offshoring their industries to countries like China. However, the extraction of green minerals presents its own set of challenges. Geopolitical tensions also threaten the global supply chains of these minerals. For example, the US heavily depends on imports for critical minerals, but Chinese control of the refining processes further complicates the situation.

Actionable trend insights as green technologies require more critical minerals

For entrepreneurs: Startups can explore novel solutions to develop more efficient tools and methods for mineral extraction, recycling technologies for battery materials, or offer niche consulting services to help companies navigate complex mineral sourcing markets. Similarly, there will be a demand for patents directed at building green tech that uses less rare earth minerals, or cheaper/more commonplace minerals. Unfortunately, many innovations within this sector will be capital-intensive, requiring VC support.

For corporate innovators: Companies can partner with green tech startups and university research labs to explore and invest in novel research and development projects that create more efficient and sustainable technologies for mineral extraction. Large manufacturers may need to lobby their governments to pursue access or mining rights to domestic and international mineral reserves, as well as hire geopolitical analysts to better strategize their investments in unstable but mineral-rich nations.

For public sector innovators: Governments can implement policies encouraging the transition to clean energy and the sustainable extraction of minerals. This could include offering incentives for companies to invest in clean energy technologies, implementing regulations to ensure sustainable mining practices, and investing in research and development in this field. They can also establish geopolitical partnerships and alliances to establish sustainable frameworks for the global extraction and trade of critical minerals, including considering mining's effects on developing economies.

Trending research reports from the world wide web

According to YouTube’s 2023 Cultural Trends Report, content about generative AI tools received over 1.7 billion views.

The global music industry surpassed 1 trillion streams in March, a month earlier than when the milestone was hit in 2022, according to Luminate’s 2023 Midyear Report.

Rest of World’s survey showed that 63 percent of employees think their company will hire fewer external contractors because of generative AI.

According to McKinsey, demand for office and retail space in major global cities will continue to be below pre-COVID-19 levels.

The US is experiencing re-industrialization

The US is having a significant surge in construction spending, a key indicator of a massive re-industrialization process. This process, which involves the rapid development of industrial infrastructure, factories, refineries, pipelines, and roads, is occurring faster than even during World War II. Overall construction spending in May was the highest in the last four months, growing 2.4 percent.

Two key factors contribute to this trend. First, the US boasts a highly skilled labor force. While other countries may have higher education levels or slightly more productivity per hour, the size of the US labor force allows for a broad range of capabilities. Historically, the US has focused on high-value-added tasks, leaving lower-value manufacturing to other countries.

Secondly, the Shale Revolution has led to abundant natural gas in the country, a critical component in various manufacturing processes. This revolution has made the US independent in terms of natural gas and oil, and has encouraged the build-out of industrial infrastructure, particularly in chemicals. Recent issues, such as the COVID-19 pandemic, have highlighted the unreliability of international supply chains, leading to a push for domestic production. This shift, coupled with the Inflation Reduction Act (IRA), which injected a trillion dollars into the system for infrastructure build-out, has further accelerated construction spending.

Actionable trend insights as the US increases industrial infrastructure construction

For entrepreneurs: Building physical things is in fashion again. Investing in traditional construction and labor management companies will see sustained returns, especially those that can apply innovative solutions, from improving construction processes to project management software to enhancing site safety measures. Startups can also explore applying recent AI and machine learning breakthroughs to construction robotics to produce specialized robots that can learn and adapt to different construction environments, making them safer, more efficient, and cost-effective.

For corporate innovators: US Companies with any future expansion plans on the books will be incentivized to accelerate their CAPEX expenditures to take advantage of IRA funding options. Onshoring, nearshoring, and friendshoring initiatives, coupled with aggressive investments in workplace and factory automation, will result in more resilient, cost-effective, and environmentally-friendly supply chains. Major construction companies will see increased and sustained growth for the next two decades, especially those that invest in next-gen construction tech, such as giant, construction-oriented robots and 3D printers.

For public sector innovators: Governments can continue to support large-scale infrastructure projects, especially those that support next-generation technologies like 5G, EV charging networks, and smart electrical grids. These initiatives would lay the foundation for long-term economic development through improved private and public services. The public sector can also invest in workforce development programs specifically designed to train workers for the construction industry. These programs could range from short-term vocational training courses to apprenticeships and degree programs in construction management or civil engineering.

Outside curiosities

The Barbenheimer memes are nonstop and have contributed to the marketing success of both films.

The future of live events is jaw-dropping, immersive ceiling screens.

Be amazed at these regularly updated images taken by the USD $10-billion James Webb Space Telescope. (Still staring at The Pillars of Creation.)

A touch of Innovator's Dilemma as Ford CEO explains why legacy car manufacturers struggle to compete with Tesla and emerging Chinese EV automakers in software development.

Living beside the new Las Vegas Sphere must be weird.

Jetpack racing. Of course, it would come to this.

Access discounted rates to the Quantumrun Foresight Platform on NachoNacho.

More from Quantumrun

Read more daily trend reporting on Quantumrun.com

Subscribe to the Quantumrun Trends Platform (free for premium newsletter subscribers)

Corporate readers can review our Trend Intelligence Platform

Follow us on Linkedin

Follow up on Twitter

Finally, share your thoughts in the Substack comments below. We love hearing from you!

David Tal, Quantumrun President: Interested in collaborating with the Quantumrun Foresight team? Learn more about us here.

See you in The Futures,

Quantumrun