The Futures - No. 21

From Quantumrun

In this issue

The Quantumrun team shares actionable trend insights about why blue-collar workers are experiencing better wage growth, the ripple effect of China's economic woes, AR redefining the future of street art, and quantum scientists manipulating time.

Future signals to watch

Talent scouts in the music industry are being slowly replaced by social media, robots, and algorithms.

The Biden Administration announced a massive USD $1.2 billion investment in carbon dioxide removal facilities.

Scientists have successfully mapped the entire Y chromosome, which could help us better understand various medical conditions, from infertility to cancer.

A new study suggests that solar power is poised to overtake hydropower as Africa's primary electricity source due to the declining economic viability of new hydropower projects.

Speaking of investments in Africa, with China scaling back as the continent’s primary investor, the Gulf Cooperation Council countries, including Saudi Arabia, the UAE, and Qatar, have stepped in, investing USD $8.3 billion across several African nations in 2022.

Researchers found that in the quantum realm, the flow of time can be manipulated—sped up, slowed down, or reversed—by altering quantum states at different points in time. (Don't get too excited; this doesn't mean human time travel.)

Researchers used chatGPT to simulate the spread of a virus in a fictional US town of 100 people, offering an alternative to traditional mathematical models for studying outbreaks.

Google's Arts & Culture Team is exploring new avenues to enhance murals using Geospatial Creator, transforming street art into an immersive AR experience.

Blue-collar wages are outstripping white-collar wages

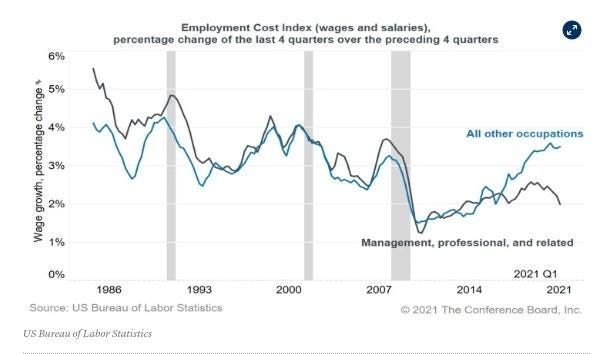

As young people evaluate their career options, there's a noticeable shift in the landscape of opportunity. While college enrollment in the US declined from 69.1 percent in 2018 to 62 percent in 2022, another trend is turning heads: the accelerating wage growth of blue-collar jobs compared to their white-collar counterparts. This is a reversal from past decades when white-collar jobs—often requiring a college degree—consistently outpaced blue-collar jobs in wage growth.

Several factors are driving this change. First, there's a tight labor market for blue-collar jobs driven by early retirements during the pandemic and reduced US immigration. This shift has increased demand for construction, food services, and retail workers, pushing wages higher. Meanwhile, white-collar industries like tech have not seen the same level of wage growth, partly because these jobs were less affected by pandemic-related disruptions.

Due to slowing demographics, economists point out that this wage growth among blue-collar workers is not just a temporary phenomenon but has broader economic implications. Higher wages for lower-income workers have increased their spending power, helping to support economic growth and potentially staving off a recession. While the wage gap between blue-collar and white-collar jobs remains, the gap is narrowing. This shift suggests that trade schools and apprenticeships are increasingly viable paths to financial stability, challenging the long-held belief that a four-year college degree is the only route to success.

Actionable trend insights as blue-collar wages outpace white-collar ones

For entrepreneurs: Given the increasing demand for specialized blue-collar skills, experienced tradespersons can develop local training, mentorship, or apprenticeship courses/workshops/programs that can rapidly train (or re-train) young workers for in-demand professions. Digital entrepreneurs and HR professionals can earn premiums if they develop networks or temp worker agencies to train and supply a reliable stream of blue-collar workers to companies in need.

For corporate innovators: Companies, especially those in manufacturing or logistics, could consider establishing in-house training programs for specialized skills. For example, a shipping company could offer courses in advanced GPS systems or automated logistics management, making their workforce more skilled and justifying higher wages. With the rising wages in blue-collar jobs, corporations may need to focus on employee retention to avoid the costs associated with high turnover, including signing bonuses, comprehensive healthcare packages, or even stock options, which are usually reserved for white-collar employees.

For public sector innovators: Government agencies could offer subsidized training programs in high-demand blue-collar fields. For instance, a city facing a shortage of public transport drivers could provide free training courses for residents, ensuring a steady supply of skilled workers for the future. The government could offer tax incentives to encourage companies to invest in employee training and wage growth. For example, a tax break could be given to companies that show a specific percentage increase in blue-collar wages or invest in upskilling their employees in areas that are less likely to be automated.

Trending research reports from the World Wide Web

A think tank report discovered that despite commitments to cut back, the G20 nations invested a record USD $1.4 trillion in fossil fuels in 2022.

The 2023 Global Trends in AI Report reveals that 69 percent of organizations have at least one AI initiative up and running, and 28 percent have successfully scaled AI across their enterprise.

According to McKinsey’s The State of AI in 2023 Report, generative AI tools are most commonly used in marketing and sales, product and service development, and service operations.

A fascinating deep dive into why many Creator Economy startups fail.

What China’s economic woes mean for everyone

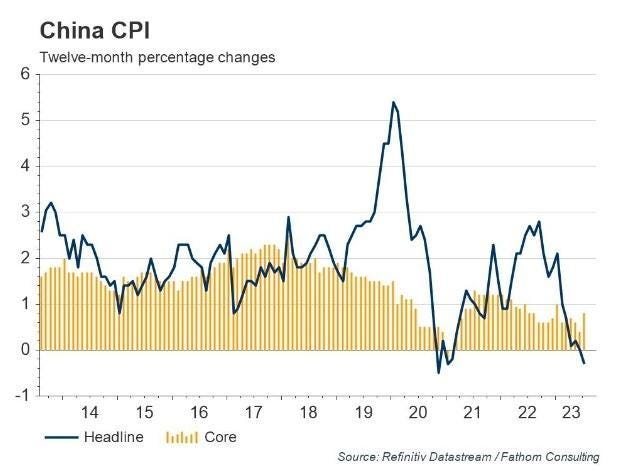

Unlike other countries that saw a surge in consumption post-Covid, China's economic growth has been sluggish, with imports and exports declining. This downturn is partly due to long-term demographic shifts, as China's birth rate has fallen by about 40 percent from 2017 to 2021, reducing the number of young consumers long term. In 2022, China's birth rate plummeted to an all-time low of 1.09, marking the lowest fertility rate among nations with more than 100 million people.

Another significant issue is deflation, a decrease in the general price level of goods and services. While short bursts of deflation are manageable, China's situation could start a deflationary spiral caused by an imbalance between supply and demand. This spiral is particularly concerning given China's economic model, which relies heavily on state-led investment rather than consumption or exports. Attempts to stimulate the economy through more government investments are likely ineffective due to diminishing returns on capital (in other words, China may be approaching a limit to the number of new government infrastructure projects that can drive outsized economic returns).

The economic slowdown in China has global repercussions. Companies worldwide selling to or sourcing from China are revising their revenue expectations downward. Such revisions are affecting stock markets globally, with a particular impact on firms with significant exposure to China. The US has also imposed new investment restrictions on Chinese tech sectors, further straining economic relations between the two countries. The situation is leading to a redistribution of manufacturing work to other Asian nations, such as Vietnam, Thailand, Malaysia, and Indonesia, and more onshoring in Western countries.

Actionable trend insights as China’s economic challenges cause a ripple effect globally

For entrepreneurs: As manufacturing moves from China to other countries, there will be a need to establish new quality control measures. Entrepreneurs could start consultancies that help transitioning companies maintain product quality, ensuring they meet local and international standards. Likewise, as the cost of Chinese manufacturing grows, small to medium-sized retailers (especially small dropshipping businesses) in other countries may be forced to reassess the viability of their business models.

For corporate innovators: Larger companies can preempt growing labor costs caused by manufacturing shifts by investing in automation technologies, such as automated assembly lines and AI-driven quality control systems. Corporations that relied heavily on Chinese suppliers could accelerate their supplier network diversification across neighboring countries. This exercise could also open up new avenues for products and materials not previously considered.

For public sector innovators: Governments (especially across Asia) can offer tax breaks, subsidies, or low-interest loans to encourage companies to set up manufacturing units in their countries. As China becomes less dominant in the global market (by the 2030s), governments could focus on strengthening trade relations with other emerging markets. This trade diplomacy could involve negotiating new trade deals or simplifying visa processes for business travel to these countries.

Outside curiosities

This startup has created a shoe gadget that can increase walking speed by as much as 250 percent. (Think moving treadmill on wheels.)

This French visual artist uses computer graphics, photography, and architecture to create mesmerizing AI-generated videos.

A band of researchers and “monster hunters” flocked to the Scottish Highlands to look for the Loch Ness Monster, touted as the “biggest search for the legendary beast in more than 50 years.”

Fresh from its Moon landing triumph, India is off to its next major goal: the Sun.

If you’re a service worker, would you feel comfortable having this productivity monitoring system in your workplace?

More from Quantumrun

Read more daily trend reporting on Quantumrun.com

Subscribe to the Quantumrun Trends Platform (free for premium newsletter subscribers)

Corporate readers can review our Trend Intelligence Platform

Follow us on Linkedin

Follow up on Twitter

Email us at contact@quantumrun.com with questions or feedback.

Finally, share your thoughts in the Substack comments below. We love hearing from you!

David Tal, Quantumrun President: Interested in collaborating with the Quantumrun Foresight team? Learn more about us here.

See you in The Futures,

Quantumrun