The Futures - No. 34

The risks of adopting AI in central banks / Shoplifting spikes in cities globally / The ultimate AI gamer

In this issue

The Quantumrun team shares actionable trend insights about central banks adopting AI, why some global cities are experiencing a shoplifting epidemic, the DeepMind AI pro gamer, and the robot-run NYC restaurant.

Future signals to watch

Researchers at Google’s DeepMind created a computer program that learns to play chess, Go, and poker better than humans by blending two methods: exploring different game scenarios and improving through self-practice. This breakthrough could speed up the development of smarter AI that can handle many different tasks.

Hyundai will become the first brand to sell its vehicles on Amazon's US store.

Amid fluctuating crypto prices, significant finance firms are increasingly investing in or developing token trading platforms, signaling a growing market for digital tokens representing various assets.

Soon, Uber “drivers” can be hired to do household chores, such as yard cleanup, garden maintenance, and snow removal.

As automobiles develop more advanced autonomous features, companies are making in-car gaming a thing.

University of Connecticut scientists created a plastic alternative using clothing waste.

The US military is experimenting with various low-cost AI-powered vehicles to catch up with China’s advancements.

Remy Robotics introduced a new blended concept in AI-powered restaurants, where humans prepare food off-site, and robots complete the process inside the restaurant.

Culturally // Trending

YouTube → Inside Out 2 // X → The Playa Crawler // Reddit → All locked up // TikTok → Private chefs // Instagram → Moving back in with parents // Spotify → “Can’t Catch Me Now”

💡 Watch Quantumrun’s trend videos on Linkedin & YouTube & Instagram & TikTok

💹 Should we allow AI to become a central banker?

Next-generation artificial intelligence systems are being aggressively adopted in banking, primarily to improve macroeconomic forecasts, process complex data, and identify anomalies. For example, investment company Amundi built its own AI infrastructure for research on macroeconomics, and JP Morgan is extensively using AI in fraud detection.

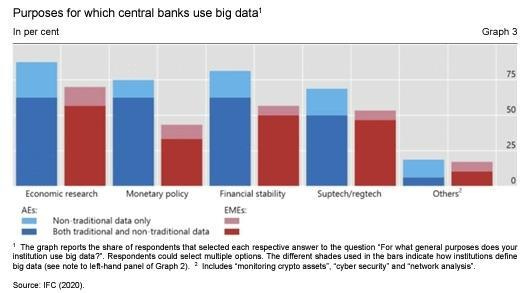

Even central banks, typically cautious with new technologies, are becoming convinced of AI’s ability to enhance their operations. The use of AI among central bankers is gaining momentum worldwide, as seen in initiatives like the Bank of Indonesia using machine learning (ML) to assess foreign investor impact and the Banque de France employing AI for market forecasting.

Despite AI's potential to streamline data analysis and enhance economic predictions, its use in central banking raises significant concerns. Issues of data quality, privacy, and the risk of algorithmic convergence (the output starts reflecting some specific number) are prominent.

For instance, data biases—often overlooked—can lead to misleading outcomes. AI's complexity may conceal flawed models or data, posing risks to financial stability. Using unstructured data, like social media content, in economic projections raises privacy concerns. Moreover, the prospect of AI-driven convergence in central bank strategies could lead to market volatility.

While AI excels in tasks with clear rules and abundant data, such as micro-prudential rule enforcement, its limitations become apparent in more complex economic scenarios requiring abstract analysis and unique decision-making, like responding to financial crises. These challenges need senior decision-makers in central banks to understand how AI's advice differs from human input and to adapt their organizational structures and human resource policies accordingly.

This strategic approach aims to harness AI's potential without compromising the core mission of these influential institutions. As AI technology evolves and becomes more embedded in central bank operations, decision-makers need to remain vigilant in managing its influence and ensuring that critical decisions retain a necessary human element.

Actionable trend insights as central banks increasingly use AI

For entrepreneurs

Startups can create platforms that democratize access to AI-driven economic insights, previously available only to large financial institutions. By translating complex central bank data into understandable forecasts and trends, these platforms can assist small businesses and individual investors in making informed decisions.

For corporate innovators

Financial companies can invest in AI-driven risk assessment tools that use central bank data to more rapidly predict market shifts, identify emerging sectors for investment, and adjust credit risk models. This approach can help diversify investment portfolios or adjust lending strategies in response to anticipated economic changes.

For public sector innovators

Government agencies can adopt AI models to better align their fiscal policies with central bank predictions. By integrating AI forecasts into budget planning and policy development, they can more effectively manage public funds and respond to economic shifts.

For example, a local government could use AI to analyze how changes in interest rates might affect municipal bond markets, adjusting their funding strategies accordingly to ensure optimal investment in public projects. This proactive approach would enable more effective and responsive governance in line with evolving economic conditions.

Trending research reports from the World Wide Web

Ethics.org discusses what aged care funding means for intergenerational justice and the social contract.

Autonomy’s study shows that 28% of the UK’s workforce will work only 32 hours a week by 2033.

Rest of World discusses how Chinese e-commerce sites like Shein and TikTok Shop dominated global online shopping.

According to the creative agency We Are Social, the attention economy is transitioning to the immersion economy.

An Ernst & Young survey discovered that 45% of student respondents wish their universities to prioritize technology investments in enhancing teacher training for more effective digital learning delivery.

🚨 Global cities are experiencing a shoplifting epidemic

Throughout 2023, major global cities have experienced a significant rise in shoplifting, causing concern among major retailers. In the UK, the issue has escalated to a point where it's impacting both retailer revenue and staff safety. The John Lewis Partnership's chair highlighted the severity of this trend, pointing out industry-wide losses of approximately £1 billion due to shoplifting.

In response, several retailers are investing in Project Pegasus, aiming to use facial recognition technology to identify repeat offenders. The situation has reached a critical point with coordinated lootings, as seen in London, where groups inspired by social media trends have targeted stores, causing closures and confrontations with law enforcement. The UK Home Secretary has vowed strong action against such lawlessness.

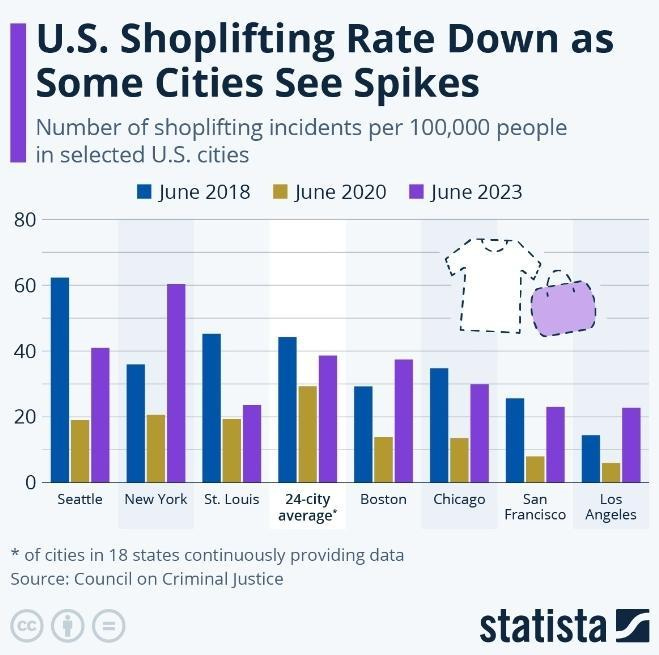

Similarly, in the US, cities like New York, Los Angeles, and San Francisco have seen alarming increases in retail theft. For instance, New York City (NYC) shoplifting complaints have risen annually since 2018 (excluding 2020), peaking with a 44% jump from 2021 to 2022, as reported by the mayor's office.

In response, retailer Target announced in September 2023 that it plans to shut down stores in NYC, Seattle, San Francisco, and Portland, citing safety concerns for staff and customers due to escalating theft and organized retail crime.

The Council on Criminal Justice attributes this rise in shoplifting to various factors, including weakened bail reform laws, reduced policing budgets, and increased reporting of retail thefts. One of the major reasons for the surge is inflation. Despite a slight cooling, the prolonged period of high prices has worsened financial struggles, with the end of COVID-19 aid aggravating the situation. Retail experts think this trend in crime reflects broader social distress, noting a surge in large-scale theft and a general normalization of bad behavior.

Actionable trend insights as shoplifting incidents worsen in global cities

For corporate innovators

Retail companies could invest in advanced data analysis tools integrating inventory management with real-time surveillance. By utilizing AI algorithms, these systems could identify unusual activity patterns, predict potential theft incidents, and prompt preemptive actions. This technology minimizes losses and aids in better inventory management, leading to more efficient store operations.

Firms can also experiment with virtual reality (VR) training programs for their staff to better prepare them for theft incidents. These programs could simulate various shoplifting scenarios, teaching employees how to respond safely.

For public sector innovators

Government agencies can adopt a multi-agency approach to address the shoplifting surge. This strategy could involve creating specialized task forces that combine resources from law enforcement, social services, and economic development agencies.

Municipalities and state/provincial governments may look at reintroducing stricter legal penalties and fines for theft, as well as increased policing budgets to patrol retail centers. Increased budgets for social welfare programs may also ease the financial strains forcing some to resort to theft.

Outside curiosities

Researchers discovered for the first time that dolphins know how to steal bait from crab pots and nests.

Australia built a climate change-resilient museum that houses 4,000 contemporary art pieces.

Earth 2050 by Kaspersky is a fascinating glimpse of our future world.

OpenAI’s recent drama has more twists and turns than a telenovela. Sam Altman is back, and two board members are out … for now.

If you’re wondering why your grocery staples have gone out of control, here’s why.

More from Quantumrun

Read more daily trend reporting on Quantumrun.com

Subscribe to the Quantumrun Trends Platform (free for premium newsletter subscribers).

Corporate readers can review our Trend Intelligence Platform

Email us at contact@quantumrun.com with questions or feedback.

Finally, share your thoughts in the Substack comments below. We love hearing from you!

David Tal, Quantumrun President: Interested in collaborating with the Quantumrun Foresight team? Learn more about us here.

See you in The Futures,

Quantumrun