The Futures - No. 52

Technology driving economic growth / Boomers unable to afford retirement / AI-graded exams

In this issue

The Quantumrun team shares actionable trend insights about how automation and AI are accelerating economic growth, Boomers struggling to retire, small language models (SLMs) gaining the spotlight, and Texas rolling out an AI-assisted grading system for its student exams.

Future signals to watch

Wall Street banks are mobilizing billions to reclaim their position in leveraged finance, competing against dominant private equity and asset management firms in a revitalizing credit market driven by paused monetary tightening and diverse lending expansions.

A shift from large to small language models (SLMs) is gaining momentum, with these more compact, efficient models poised to reshape AI development by offering tailored, domain-specific applications and potentially better security.

This trend is fueled by the plateauing performance improvements in large language models (LLMs), highlighting that bigger may not always be better, and sparking interest in SLMs' ability to provide faster development cycles and reduced computational demands.

Latest research shows that Mexico City’s metro system, the second-largest in North America, is sinking.

Researchers at Tsinghua University have created "Taichi," an AI chip that processes data using light, achieving over 1,000 times the energy efficiency of Nvidia's H100 GPU chip, and is particularly significant amid US export restrictions to China.

Researchers at RMIT University have developed a 3D-printed metamaterial from titanium alloy with a unique lattice structure, making it 50% stronger than similar aerospace alloys, potentially revolutionizing the production of items from medical implants to aircraft parts.

The US Space Force is collaborating with Rocket Lab and True Anomaly to hold the first space military exercise to test threats in space, like aggressive maneuvers near US satellites, and explore defensive capabilities.

Not only is China dominating the global electric car market, but its electric or fuel cell medium- and heavy-duty trucks are leading this category, too.

The State of Texas Assessments of Academic Readiness (STAAR) exams will have a new scoring method, with open-ended responses graded by computers using an "automated scoring engine" that uses natural language processing. This change, part of a broader redesign to include more constructed response items and reduce multiple-choice questions, is expected to save the Texas Education Agency USD $15-$20 million annually on scoring costs.

Forward this email to a friend and help The Futures reach a wider audience :)

Culturally // Trending

YouTube → Bridgerton: Season 3 // X → Coachella hologram // Reddit → The new Atlas robot // TikTok → Temu parents // Instagram → Pringles x Crocs // Spotify → “Wanna Be”

💡 Rapid technological disruptions are driving economic growth

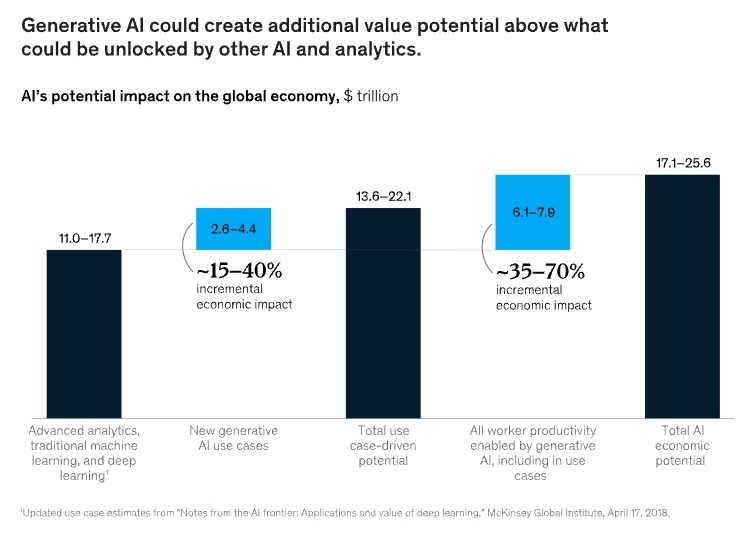

Technological advancements have historically played a central role in economic transformation. According to research by ARK Investment Management, the rate at which economies grow due to technological innovation is not just increasing; it is accelerating at an unprecedented pace (7% annually). For instance, past innovations like the steam engine and the telephone dramatically shortened the time required for economies to grow tenfold—from thousands of years to just a few centuries. Today, emerging technologies, such as AI, robotics, and blockchain, are poised to further reduce this growth interval to mere decades.

Each technological epoch has also redefined the nature of work and industry requirements. Historical data indicates that initial technology adoptions may not immediately reflect in macroeconomic statistics due to adoption delays and the time it takes for complementary innovations to emerge. For example, the introduction of electricity and personal computers initially showed modest economic impacts, only revealing their true economic potential once widespread adoption occurred, and complementary infrastructures were established. This pattern suggests that while the disruptive effects of current technologies like generative AI (GenAI) might initially appear subtle, they could soon lead to significant productivity increases and economic shifts.

These technological advancements are impacting labor markets and economic structures. Despite fears of mass unemployment due to automation and AI, historical patterns reassure us that technology typically creates more jobs than it displaces. For instance, the digital age created new fields and job opportunities in IT and digital communications, underscoring the dynamic adaptability of the labor market to technological change. This ongoing evolution shows that current workforces need to adapt and acquire new skills to ensure economic stability and career longevity.

Actionable trend insights as technological disruptions fuel economic growth:

For entrepreneurs

Entrepreneurs can explore adopting their pick of the multitude of GenAI-powered microservices that have become available over the past 24 months to streamline various business processes and augment employee productivity. Adoption of AI tools doesn’t have to be sudden, but gradual experimentation can allow your employees to find the best opportunities to enhance the value your business offers to clients.

Similarly, entrepreneurs can develop AI-powered tools and platforms that target industries that have so far underutilized next-generation technologies, such as education, healthcare, construction, etc.

For corporate innovators

Manufacturing companies can further accelerate growth by investing in adaptive robotics systems that can be easily reconfigured for different tasks without extensive retooling. For instance, during a surge in demand for electronic goods, robots could switch from assembling automotive parts to assembling consumer electronics with minimal downtime.

Logistics companies can explore integrating GenAI solutions into their existing Internet of Things (IoT) investments to further increase asset allocation and transportation efficiency and reduce operational costs. For example, logistics managers in e-commerce warehouses could interrogate GenAI systems to explore/ask for operational enhancements based on IoT devices used to monitor the locations of individual workers, machines, and merchandise.

For public sector innovators

Government agencies can invest in digital infrastructure that supports the domestic innovation ecosystem. This includes investments in next-gen server farms and high-speed internet access for underserved areas to facilitate new technology adoption among local businesses and government service delivery, especially telehealth or online education.

Governments can set more aggressive targets for government agencies to adopt digitalization programs that incorporate AI, robotics, and other forms of automation to improve service delivery standards nationally.

Trending research reports from the World Wide Web

Deloitte discusses how innovative approaches to infrastructure, driven by technological advancements and climate considerations, can significantly enhance its long-term effectiveness and societal benefit.

According to Bloomberry, remote job listings have increased by 10% in 2023 and 31% in the last six months (as of January 2024), reversing a previous downward trend since mid-2022.

The RIBA Journal discusses the strategic value of future-oriented thinking to identify and address emerging threats and opportunities.

Think tank Green Alliance thinks that combining the four worldviews of agriculture—traditionalists, agroecologists, technovegans, and sustainable intensifiers—can mitigate climate change.

🧓 Retirement is becoming impossible

The emerging retirement crisis in the US reflects a significant societal shift, where retiring comfortably is increasingly becoming a luxury rather than a norm. According to a new report highlighted by Senator Bernie Sanders, approximately half of all American households will struggle to maintain their pre-retirement living standards, with this number jumping to 56% among low-income households. Furthermore, the report reveals a stark disparity in retirement readiness, with 73% of lower wealth holders at risk of financial instability in their later years, compared to only 28% in the highest wealth bracket.

This crisis is worsened by the fact that fewer than half of Americans aged 65 and older have retirement accounts, according to the Federal Reserve's Survey of Consumer Finances. As noted by the Center on Budget and Policy Priorities, without Social Security, approximately 38% of seniors would be living below the poverty line. The lack of substantial retirement savings prompts older Americans to rely heavily on Social Security, which itself provides less support than similar programs in other developed nations. This financial vulnerability places a significant burden on US state governments, which are expected to incur a $1.3 trillion expense from 2021 to 2040 due to increased demands for healthcare and housing for financially insecure older adults.

The socio-economic impact of this retirement crisis affects not just the elderly but also the younger generations. As older Americans face financial challenges, the burden often falls on their children, contributing to what is known as the "Sandwich Generation" — adults who support both their aging parents and their own children. The increasing dependency on younger family members for financial and care support can lead to decreased savings and investment in future generations, perpetuating a cycle of economic insecurity.

Actionable trend insights as more people struggle to afford retirement

For entrepreneurs

Entrepreneurs can create residential communities that integrate affordable senior housing with family or co-share units that emphasize community support and shared resources. These developments could include communal dining areas, shared transportation services, and cooperative childcare facilities, all aimed at reducing living costs and fostering a supportive community environment.

They can develop peer-to-peer skill-sharing programs and platforms tailored specifically for retirees. These platforms would enable retired professionals to offer their expertise to younger professionals or businesses, creating a marketplace where experience is exchanged for freelance opportunities or mentorship roles.

For corporate innovators

Corporations can collaborate with financial institutions to provide their workers with new types of benefits options that subsidize various forms of senior care for the parents they care for financially.

Companies in the healthcare and consumer services industries can develop subscription-based service models that offer scaled pricing for seniors based on their retirement savings and income levels. For example, a health management company could offer a tiered subscription service that includes preventative care, routine medical check-ups, and health coaching, with fees adjusted according to the customer’s financial situation.

For public sector innovators

Government agencies can develop smart homes geared towards low-income retirees, integrating technology that assists with health monitoring, security, and daily tasks, subsidized by public funds to keep them affordable. These smart homes could also incorporate energy-efficient technologies to reduce living costs.

State/provincial governments can also partner with technology startups to deploy mobile healthcare units that use predictive analytics to provide targeted care services to underprivileged senior populations. These units would use data-driven insights to address specific health needs, such as managing chronic diseases or providing mental health support, which are prevalent in economically disadvantaged older adults.

Outside curiosities

Ikea just launched a video gaming furniture set.

Cannes Film Festival is launching an Immersive Cinema category focusing on virtual reality (VR) films.

Check out Nike’s AI-designed sneakers.

Storiaverse is a multimedia platform that pairs writers with animators to create a “read-watch” experience.

Finally, an exoskeleton for hikers (goodbye to backaches).

More from Quantumrun

Read more daily trend reporting on Quantumrun.com

Subscribe to the Quantumrun Trends Platform (free for premium newsletter subscribers).

Corporate readers can review our Trend Intelligence Platform

Email us at contact@quantumrun.com with questions or feedback.

Finally, share your thoughts in the Substack comments below. We love hearing from you!

Interested in collaborating with the Quantumrun Foresight team? Learn more about us here.

See you in The Futures,

Quantumrun