The Futures - No. 77

Surging house price supercycle / AI powering FinTech / Subway trains generate electricity

In this issue

The Quantumrun team shares actionable trend insights about the housing-price supercycle, FinTech becoming more intelligent through AI, Barcelona’s subway trains that generate electricity, and Amazon’s manager purge.

Future signals to watch

Barcelona's subway system now use regenerative braking technology, similar to hybrid and electric vehicles, to convert the energy from stopping trains into electricity. This powers the trains, station amenities, and electric vehicle chargers in nearby parking lots.

Digital platforms like Foursquare are shaping global tastes, leading to the rise of similar faux-artisanal spaces called AirSpace, creating a uniform experience across cities worldwide.

Google launches AlphaChip, an AI model using reinforcement learning, which accelerates and optimizes chip design, producing superhuman layouts in hours.

East Palo Alto and other California cities are testing Axon's AI-powered software to help police create faster, more objective reports, raising concerns about AI's growing role in the criminal justice system.

Greece plans to invest €20 billion by 2035 in incentives like cash benefits and tax breaks to counter its declining birth rate, which is among the lowest in Europe.

California introduced the US' first law mandating clothing companies to establish a recycling system for the garments they sell.

Ukraine's heavy-duty Vampire drones are being used to transport heavily armed robot dogs to the frontlines in the war against Russia.

Morgan Stanley estimates Amazon could save $3 billion next year by cutting 13,834 managers as Amazon CEO Andy Jassy aims to reduce bureaucracy. Jassy plans to increase the ratio of individual contributors to managers by 15% to streamline operations and enhance agility.

Forward this email to a friend and help The Futures reach a wider audience :)

Culturally // Trending

YouTube → Ballerina // X → Hurricane Milton moves meteorologist to tears // Reddit → What’s going on here? // TikTok → History Tok // Instagram → Gen Z writes the script // Spotify → “Timeless”

🏠 The housing-price supercycle is here to stay

The housing-price supercycle is like a marathon that never ends, fueled by global forces like shifting demographics, urban migration, and the steady drop in interest rates.

Since the post-World War II era, governments across most of the developed world have subsidized mortgages, implemented restricted land-use policies, and supported urbanization—which has further concentrated economic activity and populations into cities. This combination of factors created an imbalance between supply and demand that has led to decades of upward price momentum in housing markets.

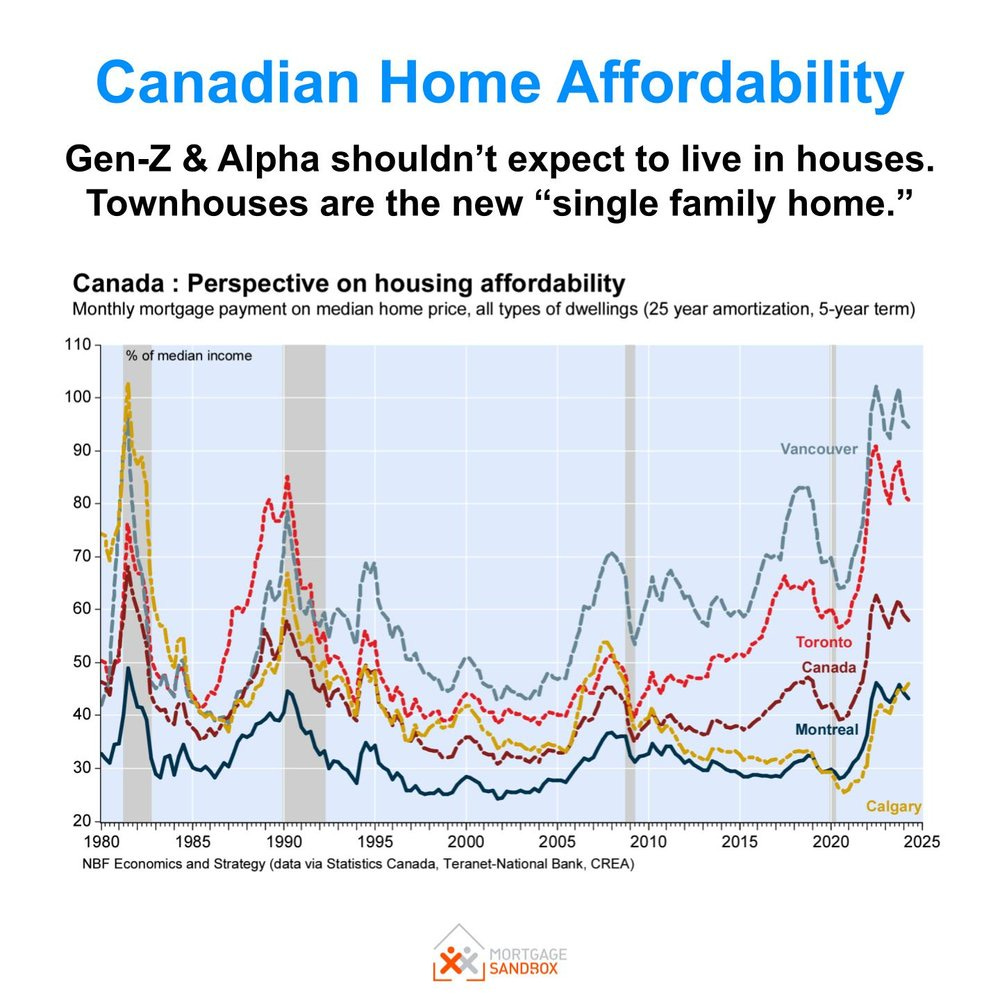

For instance, the price of homes in Canada surged even during the 2008 financial crisis when most global real estate markets saw a 6% drop in real terms, illustrating the resilience of the housing supercycle.

Another key factor contributing to the supercycle is the long-term trend of falling real interest rates. As borrowing costs decreased, homeownership became more accessible, driving up demand and pushing prices higher. According to the Bank of England, real house prices in the UK have quadrupled since the 1980s, largely due to lower interest rates, a trend mirrored in many developed countries.

Likewise, immigration is another significant driver. In Canada, a 1% rise in immigration leads to a 3.3% increase in house prices, as the growing population creates sustained demand for housing. Despite central banks raising rates in recent years, the supercycle persists, with prices rebounding after only a 5.6% drop in 2021.

Looking forward, the housing supercycle is expected to continue as demographic pressures, such as immigration and urbanization, keep demand strong. Canadian cities like Toronto and Vancouver remain highly sought after despite the rise of remote work, with many other Canadian cities seeing telecommuting rates as high as 34%, reducing the intensity of housing shortages in urban cores. However, the sustainability of this trend is questioned due to affordability concerns and high household debt.

Actionable trend insights as the housing-price supercycle surges:

For entrepreneurs

Entrepreneurs can focus on developing modular, space-efficient housing solutions tailored for high-density urban environments where property prices are skyrocketing.

For example, startups could create foldable, self-sustaining micro-homes that can be installed in unused urban spaces, such as rooftops or parking lots.

Startups in materials development could create affordable, eco-friendly construction materials.

For example, using fast-growing bamboo or hempcrete in urban housing projects could lower building costs and appeal to developers seeking sustainable alternatives.

For corporate innovators

Financial service companies can launch specialized real estate investment trusts (REITs) that target affordable housing developments in secondary cities benefiting from the telecommuting trend.

For example, companies could create REITs focused on markets where remote workers are relocating, offering attractive returns while addressing the housing demand outside of major metropolitan centers.

Retail corporations could partner with property developers to build hybrid commercial-residential spaces designed for remote workers.

For example, a retail chain could collaborate with urban planners to create mixed-use complexes that include coworking spaces, retail outlets, and short-term living units, catering to the evolving needs of remote professionals seeking flexible, affordable living environments.

For public sector innovators

Municipal governments can explore initiatives to reduce or eliminate overly restrictive land-use bylaws to encourage a more optimal use of land for residential use.

Governments can repurpose underused public land into affordable housing developments.

For example, city councils in high-demand regions could partner with developers to turn vacant lots or unused government buildings into affordable, mixed-use residential complexes that combine public services, retail, and housing for lower-income families.

They could establish national housing cooperatives that acquire properties in bulk, especially in rapidly urbanizing areas. These cooperatives could act as buffers against speculative property investment, keeping housing affordable for middle-income families.

Trending research reports from the World Wide Web

A six-year study on Antarctica's Thwaites glacier warns of its potential collapse, which could trigger a massive 3.3-meter sea level rise, endangering major global cities like New York, Kolkata, and Shanghai.

Jarand Rystad, founder of Rystad Energy, predicts peak coal consumption could occur this year or next, with China nearing its coal peak while trends in Europe and the US continue to decline.

A study from 2020 to 2023 revealed a 594% rise in young adults and teens using new weight loss drugs, with obesity rates decreasing faster among college graduates.

Although US VC investment is below its past highs, startups are still receiving more funding in 2024 than in 26 of the last 30 years.

According to KPMG’s 2024 CEO Outlook report, the respondents' top priorities over the next three years include advancing business digitization and connectivity (18%), adopting generative AI and workforce upskilling (13%), and executing ESG initiatives (13%).

💳 AI is driving next-generation FinTech

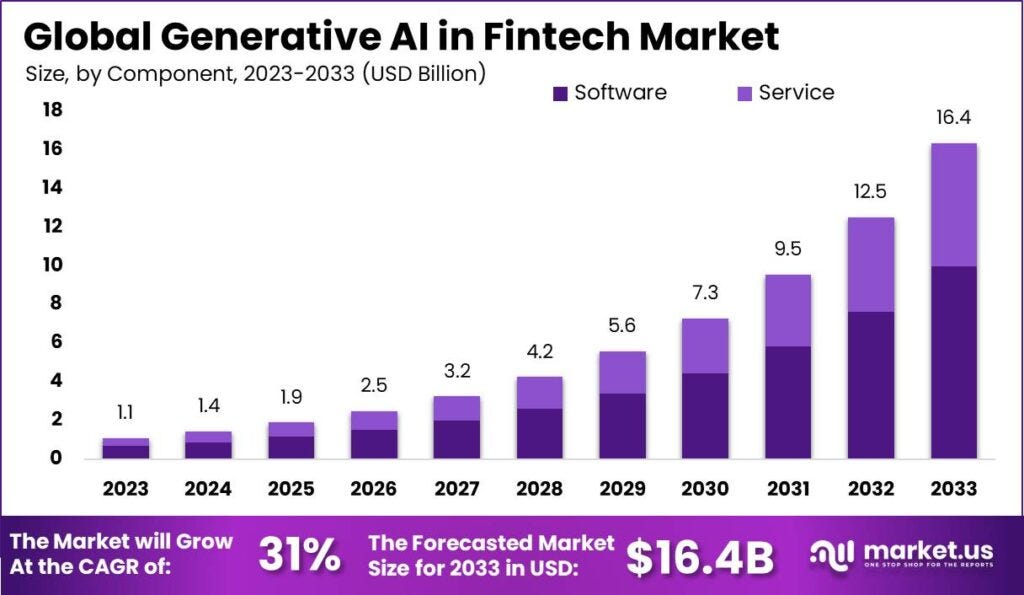

AI is reshaping the financial technology (FinTech) sector by making financial systems more intelligent, autonomous, and efficient.

This transformation goes beyond merely digitizing traditional banking services; AI enables predictive systems that anticipate financial needs before users are even aware of them. For example, Capital One’s AI-powered chatbot, Eno, efficiently handles customer service tasks, from monitoring suspicious activity to answering inquiries, demonstrating the value of 24/7 AI-driven customer support. Additionally, AI’s use in compliance and risk management is increasing, with companies like Socure achieving over 90% accuracy in digital identity verification, reducing both fraud risks and compliance costs.

A significant advantage of AI in fintech is its ability to break down legacy barriers, allowing financial institutions to modernize their systems without massive costs. Historically, banks were reluctant to overhaul their legacy software due to high expenses, but AI-driven systems are changing this perspective. For example, OakNorth Bank in the UK uses an AI-based credit analysis platform that reduces loan approval times from weeks to hours.

AI also offers cost savings through automation, with large institutions now able to augment white-collar jobs in compliance and risk management through AI copilots. This trend not only cuts costs but also creates more scalable financial models by replacing human labor with software, helping firms like Vesta and Valon revolutionize mortgage origination and servicing.

Looking forward, AI in fintech will create more personalized and adaptable services. Multimodal AI models, which process text, visuals, and audio, promise enhanced data interpretation, such as identifying suspicious financial activities based on multiple input sources. These models, coupled with the rise of specialized large language models, allow fintech companies to tailor their services more effectively. For example, AI can generate detailed financial reports by analyzing structured data, which can significantly reduce time spent on manual analysis in broker-dealer operations.

Actionable trend insights as AI drives a more intelligent and personalized FinTech:

For corporate innovators

Companies could establish partnerships with FinTech startups to co-develop AI-driven financial solutions that simplify complex supply chain financing. They can integrate AI into their finance departments to automate and optimize trade financing processes, reducing delays and minimizing risk.

Healthcare firms in the US can develop AI-driven financial solutions to improve patient billing and insurance claims processing.

For example, an AI system could predict claim approval likelihood based on past patterns, recommend alternative billing codes to maximize reimbursement, or automatically flag errors before submission.

For public sector innovators

Governments can use AI to streamline tax collection and reduce errors in revenue reporting. AI systems can analyze complex financial data from businesses and individuals, automatically flagging inconsistencies or fraud, and helping governments collect taxes more efficiently.

Governments can also use AI to speed up and deepen the audits their financial agencies perform on banks and financial services companies related to Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations.

Outside curiosities

Instagram's 'best practices' feature for professional accounts provides creators with personalized guidance on how to create and share content effectively on the platform.

FIFA is launching its fashion line.

This prototype of a drone-powered floating cart is designed to transport goods across various terrains, from supermarket floors to office stairs.

YouTube expands the Shorts’ runtime to 3 minutes.

Is there hope for Microsoft Paint now that it’s powered by gen AI?

More from Quantumrun

Read more daily trend reporting on Quantumrun.com

Become a premium newsletter subscriber and get a free one-year subscription to the Quantumrun Trends Platform.

Corporate readers can review our Trend Intelligence Platform

Email us at contact@quantumrun.com with questions or feedback.

Finally, share your thoughts in the Substack comments below. We love hearing from you!

Interested in collaborating with the Quantumrun Foresight team? Learn more about us here.

See you in The Futures,

Quantumrun

How could AI-driven advancements in FinTech reshape the financial industry, and what opportunities or risks might arise for both consumers and traditional financial institutions?